China Mutual Fund Series 4Q14

At the end of last year, China’s mutual fund industry AUM reached a record high – RMB6.95tr, split between RMB4.44tr public mutual fund AUM and RMB2.15tr non-core AUM. Capital appreciation, new product fundraising and organic inflows all contributed to growth among public mutual funds. The stock market continued to perform in Q4 following an uptick in Q3, the CSI 300 realized a near 44.2% quarterly increase. Thanks to the market rally, the Mainland mutual fund industry saw RMB300bn in capital appreciation throughout the fourth quarter alone. In 4Q14, new product fundraising (RMB166bn) reached its highest point since 2Q13. Looking to organic flows, Money Market Funds (MMFs) remained as the major contributor to industry AUM while equity and balanced funds saw outflows despite the market rally. On the regulatory side, CSRC and AMAC furthered their investigation into insider trading within the mutual fund industry. In January, CSRC announced punishing measures against five FMCs suspending their product approval process for three to six months and six other FMCs for light punishment. Meanwhile, AMAC announced punishment on six FMCs and FMC subsidiaries, suspending their segregated account (SA) registrations for three months. Looking to 1Q15, Z-Ben Advisors believes the MMF sector may see quarterly outflows for the first time since 2Q13 due to the cessation of year-end asset lending. Additionally, regulators will continue their diligence in overseeing financial markets in a bid to increase investor confidence.

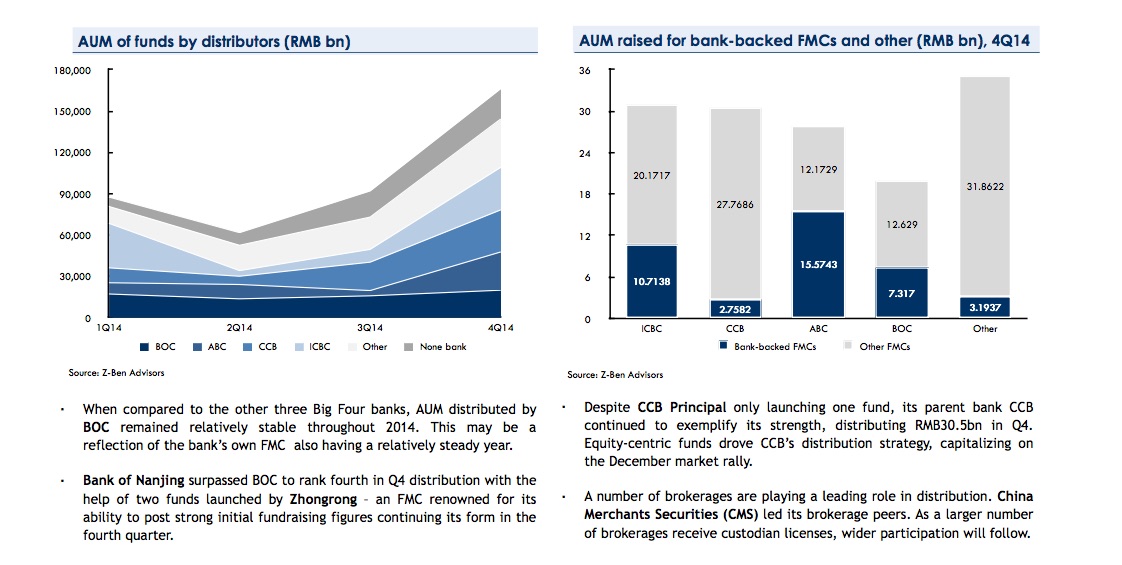

Thanks to Yu E Bao, Tianhong remained the top ranking player with 13.29% market share – the highest industry year-end market share since 2002. However, Tianhong’s shareholders, Ant Financial (subsidiary of Alibaba) and Inner Mongolia Junzheng, are currently in a profit-sharing dispute, which may potentially impact Tianhong’s market share in 2015 if Ant Financial decides to end their current partnership. In addition, four bank-backed FMCs secured seats among the industry top ten due to artificial inflows directed towards MMFs from their parent banks or institutional investors in a bid to increase year-end rankings. Looking to market share excluding MMFs, ChinaAMC ranked at the top, but it suffered a 31 bps market share (ex. MMFs) decline in 4Q14 as it faced challenges in retaining assets among equity funds. Contrastingly, ICBC Credit Suisse surpassed Invesco Great Wall, entering the industry top ten (ex. MMFs) due to an outstanding investment strategy paired with apt timing. Going forward, Z-Ben Advisors believes new product strategy and fund performance will become essential for FMCs to grow market share. Talent retention will also continue to remain a pressing challenge for managers as well.

For more information, please contact us at [email protected].

See below for report highlights: